Real Estate Agents

Minnesota Housing loan programs can help homeownership dreams become a reality. Real estate agents can assist qualified homebuyers in learning about and accessing the loan programs we have available.

First-Generation Homebuyer Loan Program is Closed

Minnesota Housing's First-Generation Homebuyer Loan Program funds have been exhausted and the program closed on December 19, 2024. We are unable to accept any more First-Generation Homebuyer Loan Commitments.

If you’d like to explore additional DPA resources that may be available for your clients, check out our other Homeownership Programs as well as the Minnesota Homeownership Center's Down Payment Assistance Search Tool. There are several first-generation homebuyer programs still available, such as the First-Generation Homebuyers Community Down Payment Assistance Fund.

Minnesota Housing would like to thank all our partners for participating in the Minnesota Housing’s First-Generation Homebuyer Loan Program and contributing to its success!

Is Minnesota Housing's program the same as the First-Generation Homebuyers Community Down Payment Assistance Fund?

Minnesota Housing's First-Generation Homebuyer Loan Program is different from the First-Generation Homebuyers Community Down Payment Assistance Fund. Borrowers cannot combine Minnesota Housing's First-Generation Homebuyer Loan with the First-Generation Homebuyers Community Down Payment Assistance Fund. The goal of both programs is to help more first-generation homebuyers access homeownership.

Visit firstgendpa.org to learn more about the First-Generation Homebuyers Community Downpayment Assistance Fund.

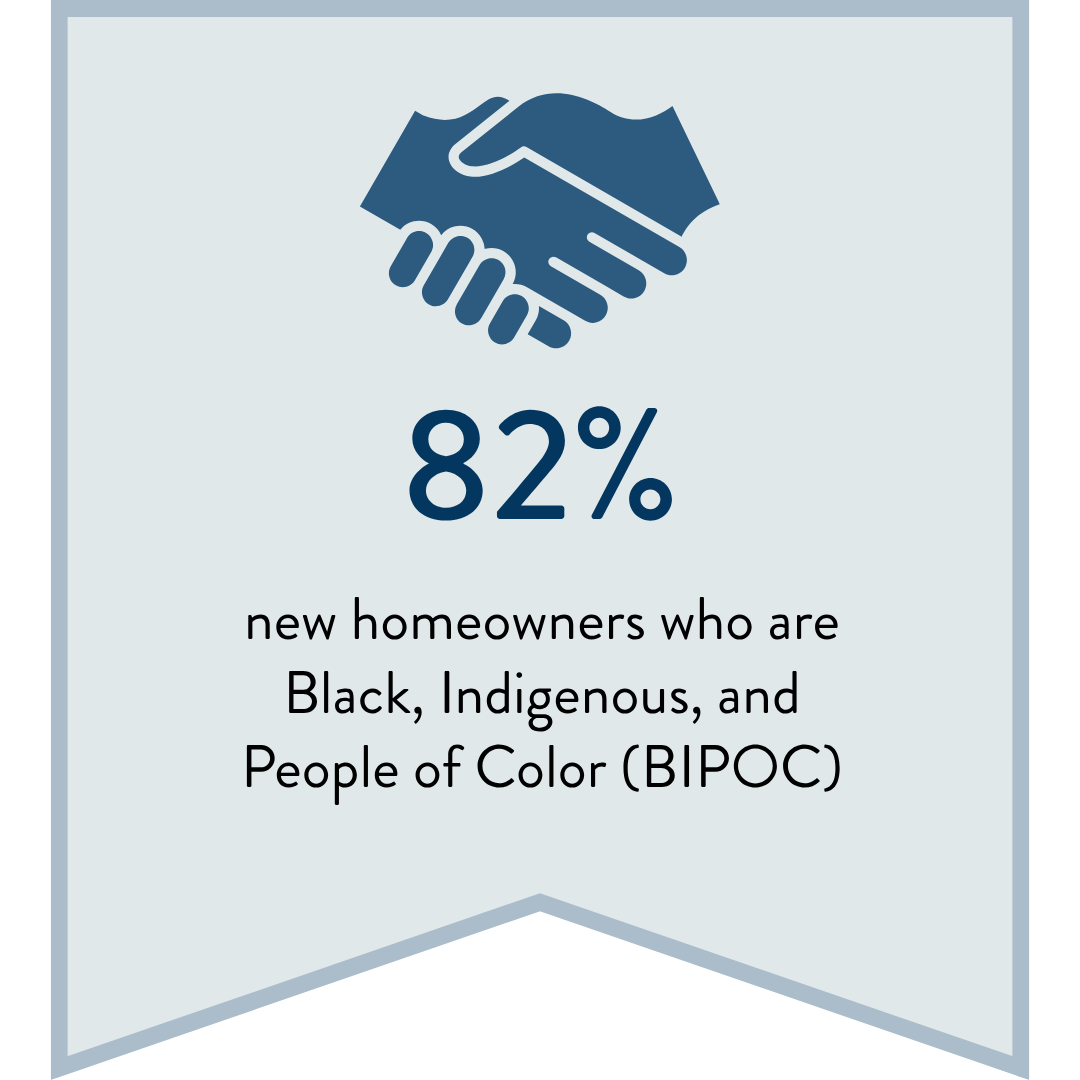

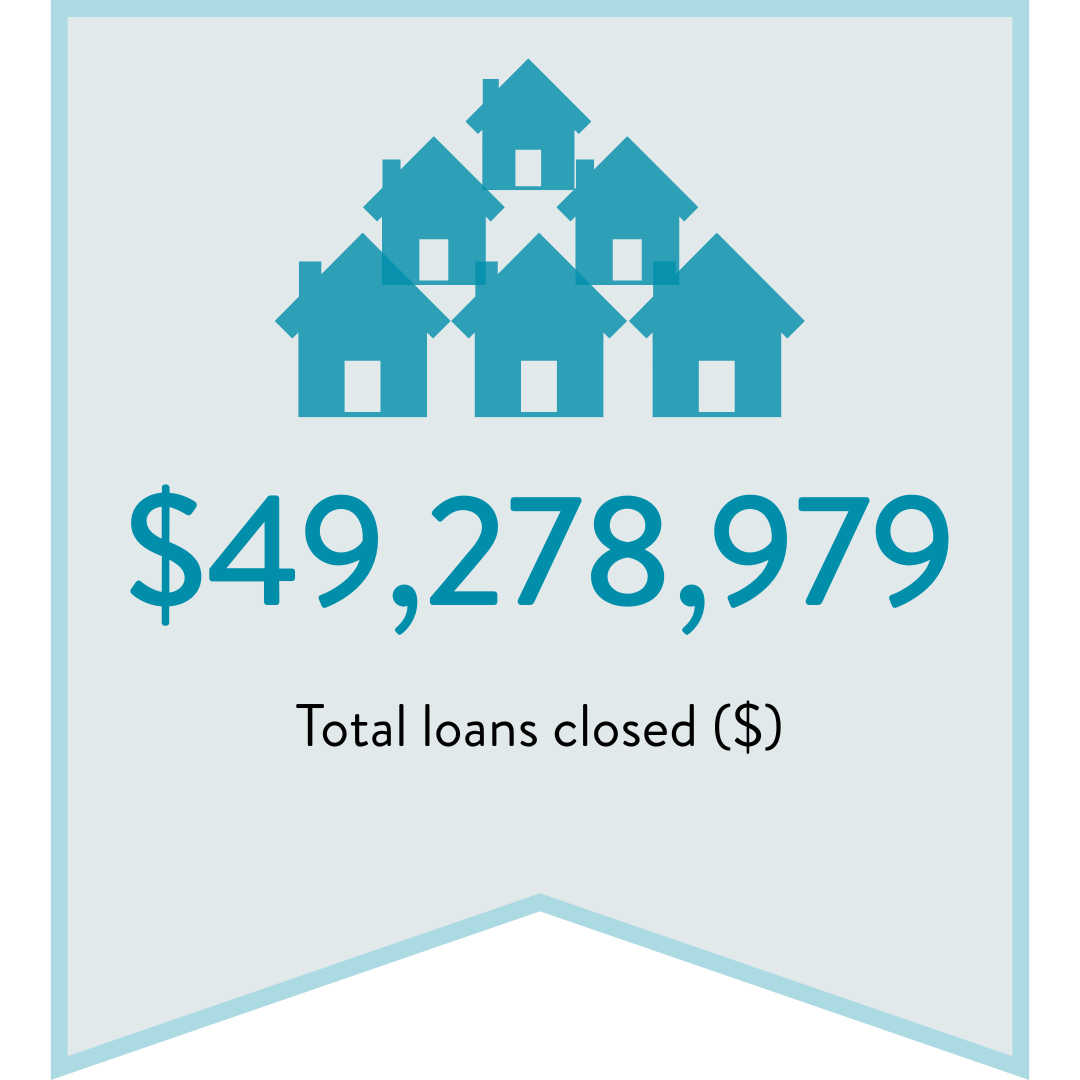

Program Results

Here is a snapshot of the initial program results. Please see the First-Generation Homebuyer Loan Program Recap for expanded data.

Continuing Education

Attend a free Continuing Education class to learn more about how our loan programs can benefit your qualifying clients.

Learn about:

- Emerging and growth markets

- The criteria for qualifying for a Minnesota Housing loan programs

- The specifics on homebuyer loan programs

- How a Home Improvement loan program may benefit a client after home purchase

- How to connect with a Qualified Lender through Minnesota Housing’s statewide Lender Network

These educational offerings are recognized by the Minnesota Department of Commerce as satisfying one or two hours of credit towards real estate continuing education requirements.

Register for a Minnesota Housing homeownership loans class by selecting a class offering below:

Please note: Online classes are the same course number, and you can only take the course once to receive course credit. Please check your Pulse Portal account if you are unsure if you have taken the course and received credit.

Bring Us to Your Office!

Bring Minnesota Housing to your real estate office for an in-person class! You and your colleagues will earn free continuing education credits and you’ll have a chance to ask questions and learn how our loan programs can benefit your clients.

If your real estate broker office is interested in scheduling a class, please complete the survey questionnaire.

Marketing Materials

Minnesota Housing offers marketing materials that industry professionals may download to help promote our programs to potential homebuyers.

In connection with Single Family Division loan programs, Minnesota Housing does not make or arrange loans. It is neither an originator nor creditor and is not affiliated with any Lender. The terms of any mortgage finance transactions conducted in connection with these programs, including important information such as loan fees, the annual percentage rate (APR), repayment conditions, disclosures, and any other materials which are required to be provided to the consumer are the responsibility of the Lender.